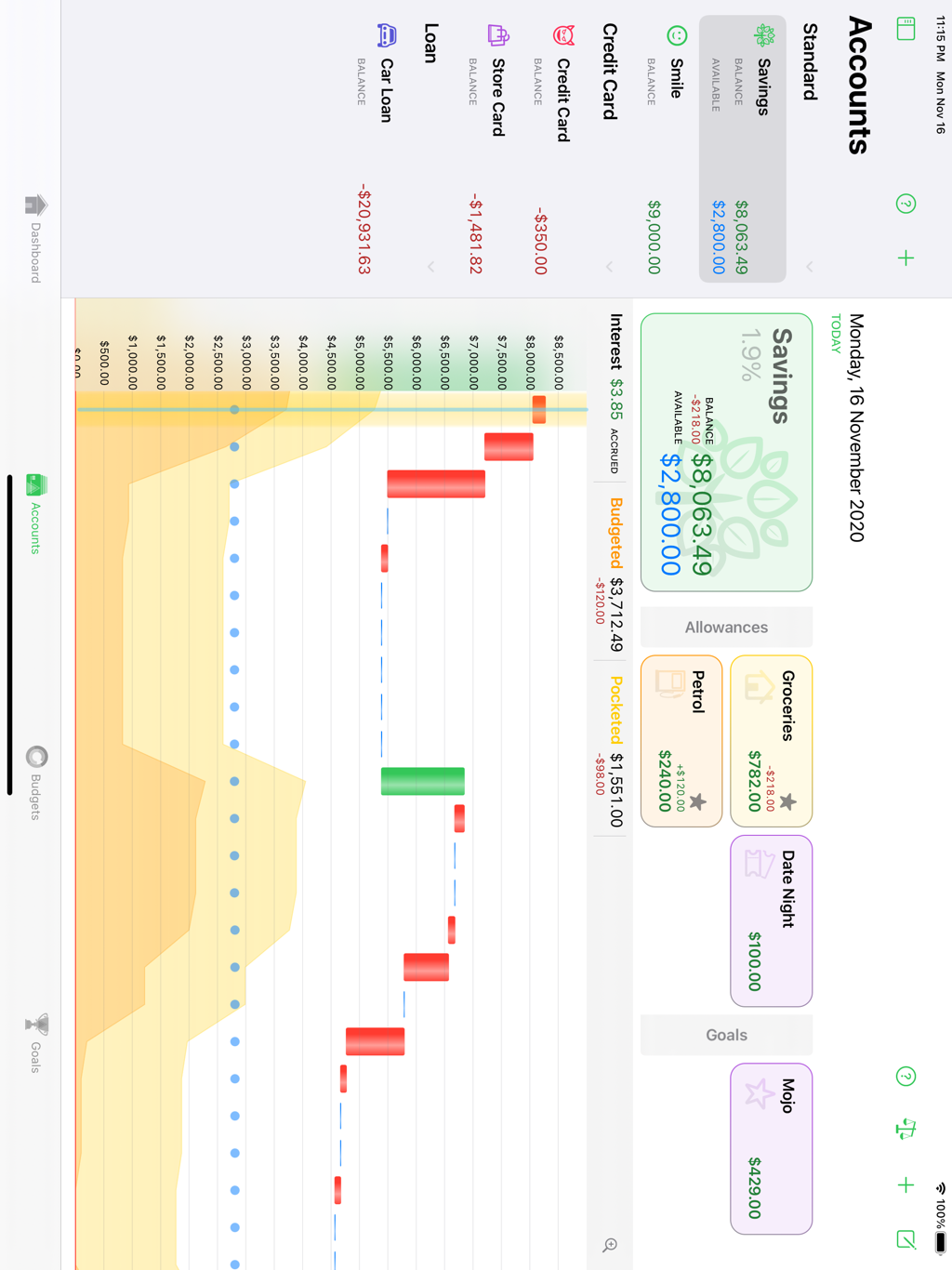

Accounts in Budget Forward are designed to be a reflection of a bank account, however they are not limited to this and can also be used to manage funds that are not in a traditional bank account such as money kept in a safe or moneybox. Budget Forward was engineered to allow you to track funds without any kind of connection to your actual bank.

In order to stay as low maintenance as possible, account balances are a source of truth in Budget Forward, meaning that even if you lapse in following the rules of your budget for a period of time, you can simply update your balances as of today and then continue your plan from that point forward. You won't need to reconcile old transactions or manually clear reminders -- simply by setting the the correct balance for each account will "clear the slate" and allow you to start looking forward again.

Budget Forward has three types of main accounts. Standard, Loan and Credit Card. Each of these have subtle differences.

Standard

This is a general purpose account type for tracking funds. As well as being able to have expenses and income applied to them, they can also:

- Have interest rates set for both positive balances

- Used as an offset account for a loan

- Have their available balance calculated based on the budgets

- Allocate income in excess of the budgeted amount to goals

- Can contain Pocket Accounts for Allowances or Goals

Loan

This is for tracking any kind of loan. Like Standard accounts, loans can have interest rates set and the simulator will estimate both accrued and applied interest in the timeline.

Loan accounts can also have a Standard account set as an offset.

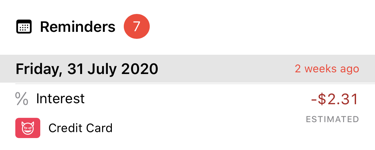

Credit Card

Credit cards are the most difficult thing to model as the rules for various cards differ from bank to bank around the world. We take the pessimistic approach when budgeting and count any owing balance as a liability. This means that interest will show as being accrued from the day an expense is added to the account. This is nothing to worry about as this is a budget and not an accounting system. If you are within an interest free period, when the statement date comes around, you can simply update the interest amount to reflect the interest actually paid, if any.

Credit cards can have also budgeted expenses allocated to them.